| 1 |

Introduction |

the enemy’s resistance without fighting.

What is this book about? It is about the taking of collateral, all of it, the end game of this globally synchronous debt accumulation super cycle. This is being executed by long-planned, intelligent design, the audacity and scope of which is difficult for the mind to encompass. Included are all financial assets, all money on deposit at banks, all stocks and bonds, and hence, all underlying property of all public corporations, including all inventories, plant and equipment, land, mineral deposits, inventions and intellectual property. Privately owned personal and real property financed with any amount of debt will be similarly taken, as will the assets of privately owned businesses, which have been financed with debt. If even partially successful, this will be the greatest conquest and subjugation in world history.

We are now living within a hybrid war conducted almost entirely by deception, and thus designed to achieve war aims with little energy input. It is a war of conquest directed not against other nation states but against all of humanity.

Private, closely held control of all central banks, and hence of all money creation, has allowed a very few people to control all political parties, governments, the intelligence agencies and their myriad front organizations, the armed forces, the police, the major corporations, and of course, the media. These very few people are the prime movers. Their plans are executed over decades. Their control is opaque. When George Soros said to me, “You don’t know what they can do,” it was these people to whom he referred. Now, to be absolutely clear, it is these very few people, who are hidden from you, who are behind this war against humanity. You may never know who they are. The people you are allowed to see are hired “face men” and “face women.” They are expendable.

One might seek comfort in thinking that this must be crazy; nothing like this has ever happened before … but it has. The precedent for the intent, design and horrific execution of such a plan can be found by examining the early 20th century, the period of the great wars and the Great Depression. The proclaimed “Great Reset” now in progress, however, includes major innovations, which will allow unprecedented concentration of wealth and of power over humanity through deprivation. How might it come to pass that you will own nothing, as so boldly predicted by the World Economic Forum? It certainly is not about the personal convenience of renting.

With the collapse of each financial bubble and the ensuing financial crisis, a story is rolled out which should now be familiar to you. It goes like this: All of us are at fault. We just wanted too much, and we were living beyond our means. And now, our collective greed has caused this terrible global crisis. The “Authorities”, the “Regulators” had struggled mightily to protect us from our own “animal spirits”, their great and elaborate efforts having been demonstrated through decades of work. Despite their good intentions, however, they failed, and can’t be blamed (or prosecuted) for that. After all, we are all to blame. In any case, let’s look forward. The financial system must be restarted, so that we can provide credit to you again, create jobs and get the economy growing, whatever it takes!

This time, what it will take is all of your property, or what you thought was your property. Here is your Central Bank Digital Currency deposited on your smart phone, so that you can buy milk. Noblesse Oblige!

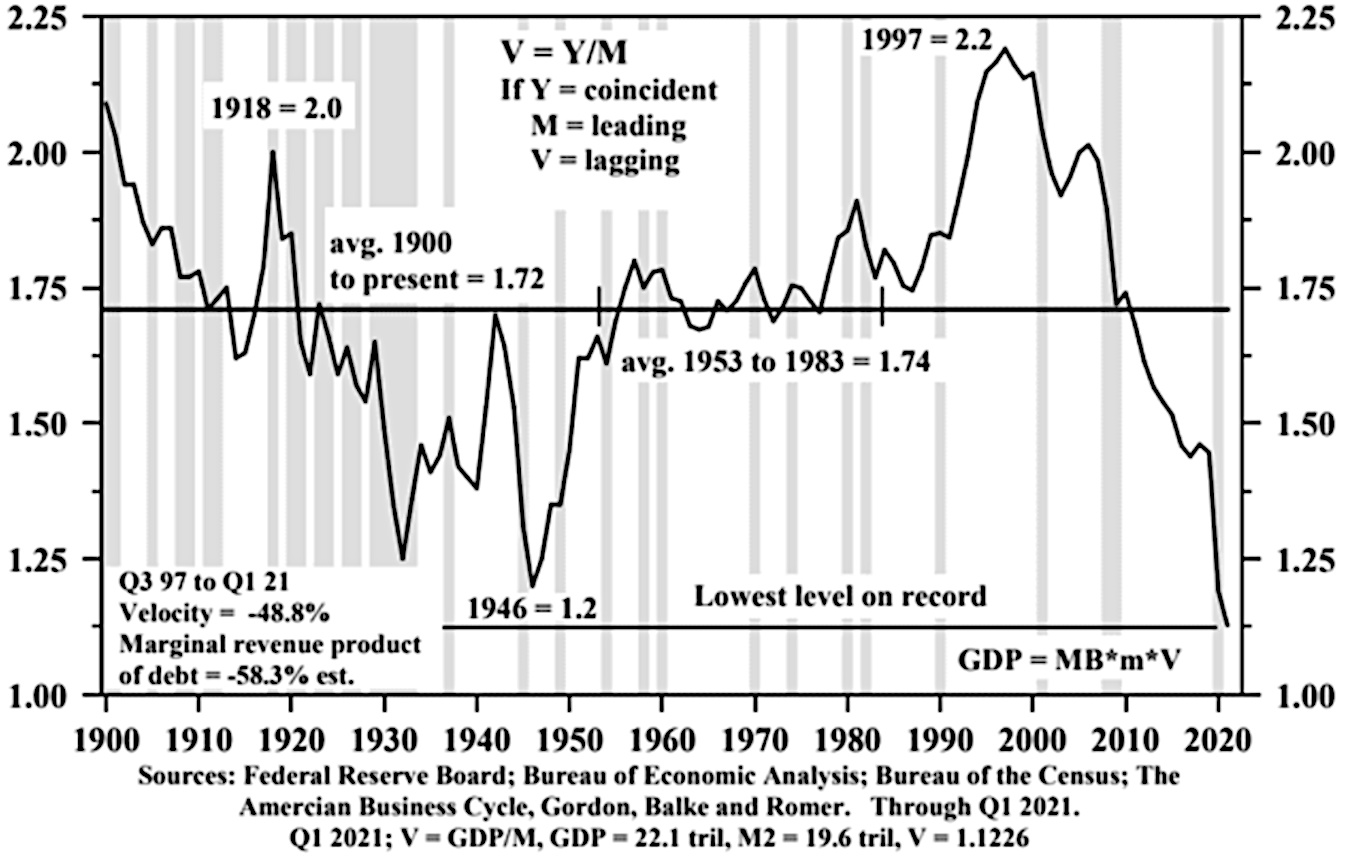

Money is an extremely efficient control system. People order themselves upon money incentives, and thus difficult, dangerous and energy intensive overt physical control need not be employed broadly. But the money control system breaks down at the end of a monetary “super cycle”, with collapse in the Velocity of Money (Velocity, or VOM). This is a multi-decade process.

Velocity is the number of times that a unit of currency is spent to buy goods and services in a period of time. This is measured by comparing the value of all goods and services produced in a period of time (Gross Domestic Product, or GDP), with the value of all cash and deposits which can be used nearly as easily as cash (Money Supply).

| Velocity = |

|

Thus, Velocity × Money Supply = GDP. Lower Velocity results in lower GDP.

Milton Friedman was an economist noted for the study of monetary history. In his book “A Monetary history of the United States, 1867-1960” [1], co-authored with Anna Schwartz, we find the following observation:

Collapse in VOM is exactly what was unfolding from the 19th century and leading up to the Great War. Within a few years, the Russian, Austro-Hungarian, and Ottoman empires ceased to exist, as did the Qing Dynasty. The German economy was destroyed. Then followed the Great Depression, the Second World War, and the slow collapse of the British Empire. No populations were unscathed. There were no winners. Or were there?

While there was widespread deprivation, selected banking interests took the collateral of the thousands of banks which were forced to close, as well as of a great many people and businesses large and small—the indebted. In the U.S., gold held by the public was confiscated. But most importantly, closely held secretive private control of central banks and money creation was maintained, as was the aforementioned control over society’s key institutions, including political parties, governments, intelligence agencies, armed forces, police, major corporations, and media.

The heirs to this control position have known for many decades that such a collapse in VOM would come again. They have been preparing. For them, it is an absolute imperative to remain in control through the collapse and “Great Reset”; otherwise they risk being discovered, investigated and prosecuted. They are not doing it for us. There is no noble purpose.

We are now living within a replay of this monetary phenomenon, i.e., a profound decline in VOM, which began when Velocity peaked in 1997. This was coincident with onset of a major global financial crisis, known as the Asian Financial Crisis, and it was followed within a few years by the Dot-Com Bubble and bust.

Throughout this period, I was managing long/short equity hedge funds, and I developed the insight that the Federal Reserve was influencing the direction of financial markets (this was considered conspiracy theory, even by my partners). At that time, it was done through Open Market Operations conducted by the New York Fed using repurchase agreements on treasury securities.

I began, systematically, following the rate of growth in M3, the broadest measure of money at the time (which is no longer published). I studied what was unfolding incrementally, and I saw that in individual weeks new money created was more than 1% of annual U.S. GDP. This was when it first occurred to me that the Fed was getting less “bang for the buck”, in that GDP was not responding to money creation. This meant that the velocity of money was inverting, and that money growth was now much higher than any GDP growth. The money being created was not going into the real economy, but it was driving a financial bubble with no relationship to underlying economic activity. I understood this, not with hindsight, but in near real-time. If I could know it, Alan Greenspan and the people he worked for knew it, too. So why did they do it? If something does not make sense, it is necessary to change one’s perspective and aim for a larger understanding. Crises do not occur by accident; they are induced intentionally and used to consolidate power and to put in place measures, which will be used later.

By the 4th quarter of 1999, when the Dot-Com Bubble was reaching extremes, I saw that the money supply was being increased at more than a 40% annual rate. I knew that this meant that the Velocity of Money was collapsing. Such a collapse occurs when the economy is not growing despite very high rates of money creation.

Please observe the extremely important chart in Figure 1.1, which was prepared by Hoisington Management. For once, one can see a true underlying determinant of the sweep of history.

Profound decline in VOM lead to the Financial Panic of 1907, which was used to justify the establishment of the Federal Reserve System. The Federal Reserve Act was passed by Congress in the quiet days before Christmas, 1913. Archduke Ferdinand was assassinated six months later.

Following a brief recovery in VOM during the Great War, it collapsed further, leading up to the closure of banks and the confiscation of gold in 1933. VOM recovered somewhat into the Second World War, and then collapsed to a low in 1946, unprecedented until now.

VOM has now contracted to a lower level than at any point during the Great Depression and world wars. Once the ability to produce growth by printing money has been exhausted, creating more money will not help. It is pushing on a string. The phenomenon is irreversible. And so, perhaps announcement of the “Great Reset” has been motivated not by “Global Warming” or by profound insights into a “Fourth Industrial Revolution”, but rather by certain knowledge of the collapse of this fundamental monetary phenomenon, the implications of which extend far beyond economics.

Something has been planned for us, but not for the reasons you have been given. How might we come to know something about the intentions of the planners? Perhaps, by examining their preparations?