| 5 |

Collateral management |

damage they will get their revenge; but if you cripple them there is

nothing they can do. If you need to injure someone, do it in such a

way that you do not have to fear their vengeance.

Associated with the imperative that certain secured creditors must be given legal certainty to client assets, globally, without exception, is the further assurance of near instantaneous cross-border mobility of legal control of such collateral.

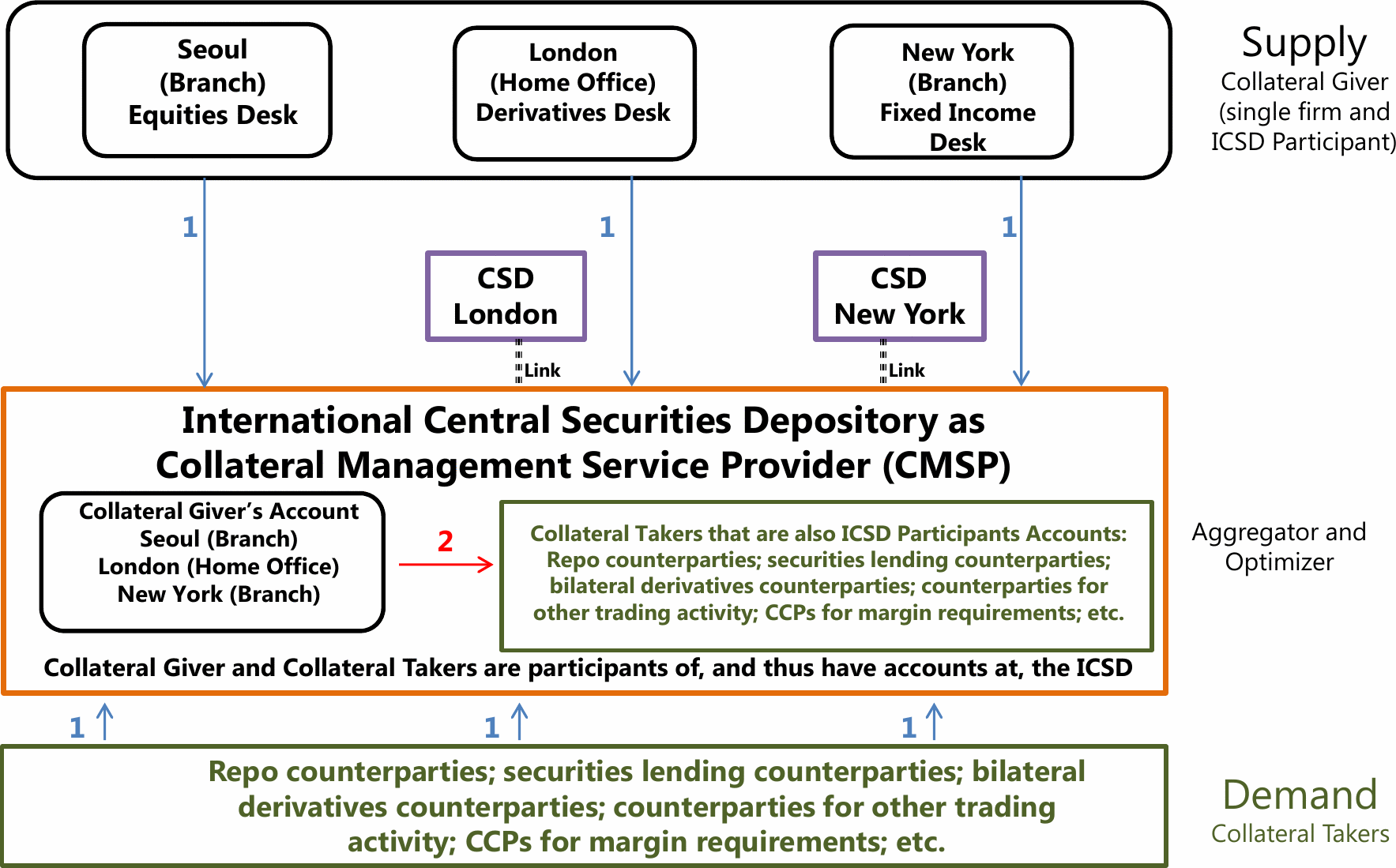

As we will see, the objective is to utilize all securities as collateral, and hence to have the real practical means to take all securities as collateral. Comprehensive “collateral management” systems have been implemented, which assure the transport of all securities cross-border through the mandated linkage of CSDs to ICSDs and on to the CCPs, where the risk of the derivatives complex is concentrated. The supposed “demand” for this enormous undertaking is not being driven by true market forces, but by regulatory contrivance.

A report published in 2013 by the Committee on the Global Financial System at the Bank for International Settlements entitled “Asset encumbrance, financial reform and the demand for collateral assets” [18] states the following:

Another report by the same committee, entitled “Developments in collateral management services” [19], states (on page 16):

and furthermore, on page i:

Thus, while there was no evidence of scarcity of collateral and market participants were not experiencing shortfalls, “demand for collateral assets”, was being artificially created and intensified by regulatory fiat. It was absolutely not market-driven.

This was designed and deliberately executed to move control of collateral to the largest secured creditors behind the derivatives complex.

Derivatives are financial contracts on everything imaginable and even unimaginable for most of us. They may be modeled on real things, but are not the real things themselves. They are un-tethered from physical reality … but can be used to take real things as collateral. This is the subterfuge, the endgame of it all.

On its pages 8-11, the cited report [19] discloses the objectives of these collateral management systems, providing further confirmation that it is the linking of CSDs and ICSDs which provides cross-border mobility of collateral from the “collateral giver ” to the “collateral taker ” (yes, they really explicitly use those terms):

The desired end goal of all these efforts is to get as close as possible to a single view of all available securities, regardless of where they are held, in real time. This aggregation of supply information is a necessary prerequisite for the efficient deployment of available securities to meet collateral obligations. …

ICSDs enable their participants to obtain aggregate views on the entirety of the latter’s securities holdings held with the ICSD, including securities held by ICSD participants via link arrangements.

The report illustrates the relationships between the ICSD and its participants in a diagram, which is included below as Figure 5.1 on page fig-bis2014. The text continues:

At this point, the report clarifies in a footnote:

The report then turns to the role of the “collateral takers”:

Note that transferral of the people’s assets is to be made free-of-payment (FoP)! They meant not just “free mobility of collateral”, but, quite literally, “free collateral.” How nice!

Through collateral transformation, the objective is to utilize all securities as collateral [19, p. 15]:

Collateral transformation is simply the encumbrance of any and all types of client assets under swap contracts, which end up in the derivatives complex. This is done without the knowledge of the clients, who were led to believe that they safely owned these securities, and serves no beneficial purpose whatsoever for these clients.

And here it is! Here is the automated, market-wide sweeping of collateral to CCPs and central banks in a time of market stress [19, p. 19]:

The automation and standardisation of many operations related to collateral management … on a market-wide basis … may enable a market participant to manage increasingly complex and rapid collateral demands.

And so as we have seen here irrefutably, the objective is to utilize all securities as collateral and hence to have the real practical means to take all securities as collateral.

Comprehensive “collateral management” systems have been implemented which assure the transport of all securities cross-border through the mandated linkage of CSDs to ICSDs to the CCPs (where the risk of the derivatives complex is concentrated), and on to the anointed secured creditors which will take the collateral when the CCPs fail, having assured for themselves that their taking of assets cannot be “legally” challenged.

Inevitably following the “Everything Bubble” will be the “Everything Crash.” Once prices of essentially everything crash and all financial firms rapidly become insolvent, these collateral management systems will automatically sweep all collateral to the Central Clearing Counterparties (CCPs) and Central Banks.

The trap, into which all nations have been herded, is ready and waiting to be sprung.

There will be an epic end point to the decades of seemingly out-of-control financialization, which served no beneficial purpose for humanity, but the devastating effects of which are apparent even now.

It has been a deliberate strategy executed over decades. This was the purpose of inflating the global bubble entirely out of proportion with any real world thing or activity, which must end in disaster for so many, with no pockets of resilience allowed to remain in any country.